Luis Alvarez

As America’s second largest retailer, Amazon (NASDAQ:AMZN) needs no introduction. AMZN’s corporate footprint is expansive, touching every area of commerce. Their success as an e-commerce retailer continues to provide an extraordinary foundation for growth across each business unit. Today, AMZN’s businesses stretch far and wide, leading the charge beyond the next generation of retail.

AMZN’s continued expansion across other businesses, including Amazon Web Services, has diversified the company. However, e-commerce remains at the core of AMZN as an enterprise. Inexorable from AMZN’s success as an online retailer is their logistics footprint. In the post-pandemic era, AMZN has driven innovation across the industrial real estate world, becoming a considerable market mover.

In fact, AMZN’s activity in the logistics space has become a powerful driver of success in recent quarterly performance. AMZN continues to expand their industrial footprint by partnering with developers to build new assets and identifying new geographies to penetrate. Following an era of tremendous expansion, AMZN has shifted their real estate strategy in two primary ways, ownership and transformation.

Today, we will explore AMZN’s real estate footprint and discuss how evolution in the real estate strategy continues to position AMZN at the forefront of the e-commerce enterprise.

Amazon Logistics Overview

AMZN remains one of the largest employers in the world. According to AMZN’s website, there are over one million employees worldwide.

We support more than one million employees around the world who are innovating and working to serve customers in our global fulfillment centers, retail locations, data centers, corporate offices, tech hubs, and headquarters in the Puget Sound region of Washington state and Arlington, Virginia.

A large portion of these employees work within AMZN’s expansive distribution network. When AMZN led the charge with two day shipping under their Prime subscription, the incentive required an unprecedented network of warehouses and distribution centers.

Historically, retailers such as Walmart (WMT) have focused on a national distribution model using fewer, larger warehouses to manage inventory. Fewer facilities resulted in a smaller footprint which was offset by innovation in supply chain management. The result was significant cost efficiency, but stagnant speed to move products to the end consumer. However, these retailers still depend on brick-and-mortar delivery, meaning they see limited incentive to copy AMZN’s direct to consumer delivery model.

AMZN changed the game by offering a wide range of products to the end consumer in two days, which has evolved into same-day delivery. To facilitate this delivery incentive, AMZN built out an unprecedented real estate footprint which included several categories of distribution centers.

Each of these facilities are highly specialized and tailored to a specific purpose. Primarily, there are larger differentiations between the sortable and non-sortable fulfillment centers. Sortable fulfillment centers and sortation centers require significantly more technology within the facility to support sorting packages efficiently. Delivery stations are typically much smaller, but are located in dense infill areas. These buildings typically hold limited inventory, but act as a throughput for AMZN and third party delivery companies to facilitate the last mile.

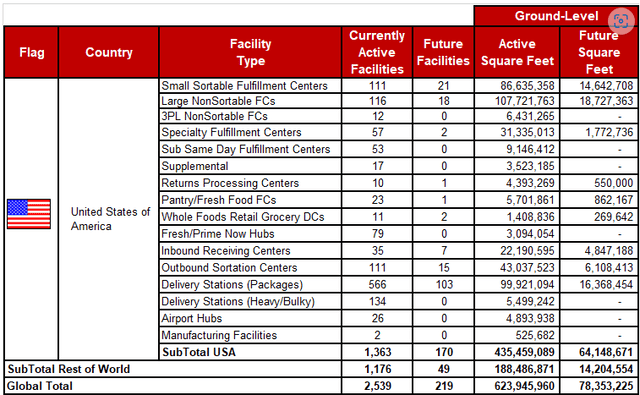

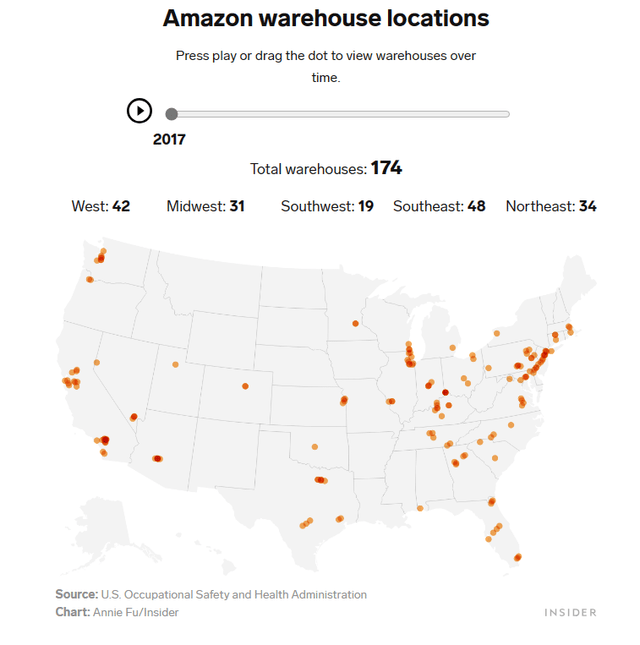

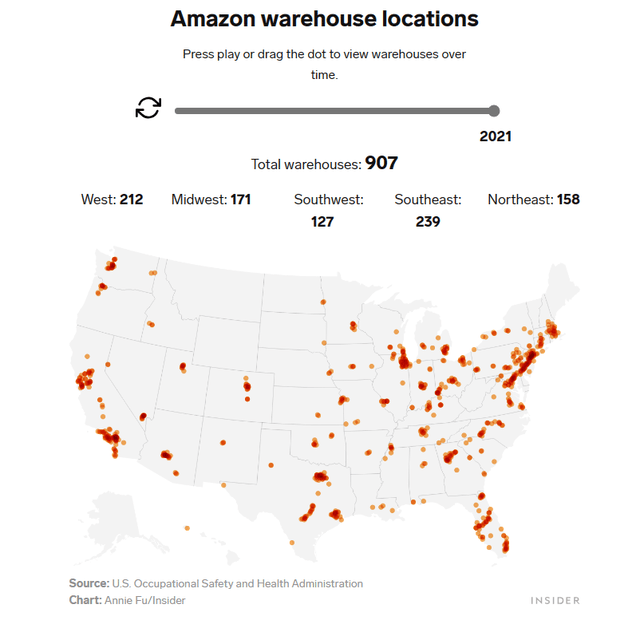

Given that AMZN offers expeditious shipping across the entirety of the United States, their logistics demands stretch across the country and more broadly, the globe. AMZN operates each of these buildings across nearly every geography of the United States, including secondary and tertiary real estate markets. According to CoStar Group (CSGP), Amazon occupies around 500 million square feet of distribution space across the country. A significant portion of this space was acquired after the pandemic. In 2017, AMZN occupied 174 warehouses across the country.

Business Insider, Data from OSHA

Fast forward to 2021 and AMZN had expanded their footprint to over 907 warehouses across a more comprehensive geography. By increasing their logistics footprint by a factor of five, AMZN charged ahead of the competition, offering unparalleled delivery capacity. The only competitive advantage left to local retailers like WMT and Target (TGT) are in-store pickup due to their expansive brick-and-mortar footprints within dense markets.

Business Insider, Data from OSHA

AMZN’s growth trajectory has continued. According to data from MWPVL, AMZN currently operates approximately 2,500 facilities around the world.

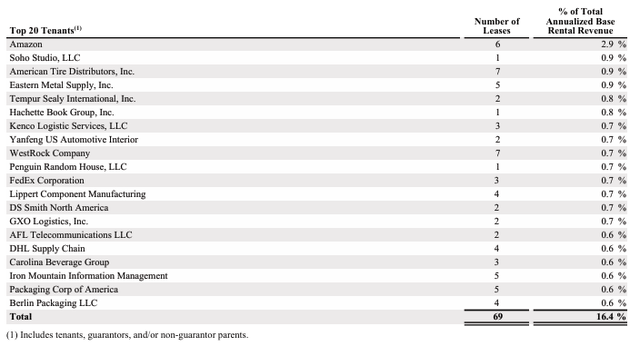

AMZN’s rapid expansion has resulted in the e-commerce becoming the largest tenant for several industrial REITs including STAG Industrial (STAG) accounting for 2.9% of rental revenue. Amazon is also the largest tenant of Prologis (PLD), the world’s largest industrial REIT, leasing over 40 million square feet.

STAG Industrial 2023 Annual Report

Over time, AMZN has become the leading edge in industrial real estate as many competitors attempt to replicate the core concepts of AMZN’s success in the logistics space. However, AMZN’s extraordinary growth after the pandemic resulted in a saturation of logistics space and capacity. AMZN’s continued development and acquisition of new warehouses and distribution centers came in addition to existing assets as opposed to in replacement of existing assets.

Amazon Culls Logistics Space

Over the past two years, AMZN has begun renovating their logistics footprint once again. As opposed to a rapid expansion like the post-pandemic era, AMZN turned to transformation. AMZN has begun offloading older warehouses in favor of modernized facilities capable of supporting their technology driven delivery process. The primary goal of the transformation being cost reduction.

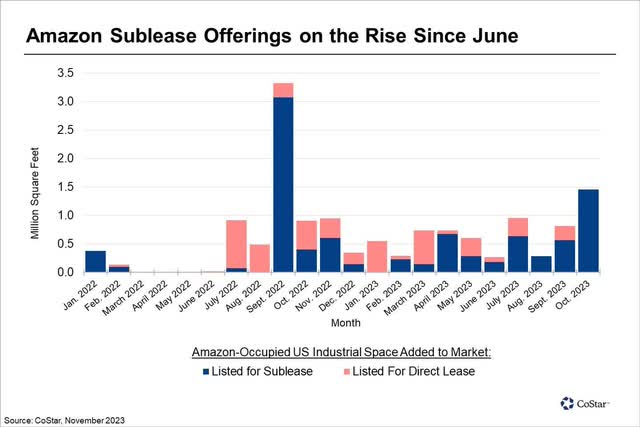

While this meant AMZN was turning over expiring leases to landlords, the process was accelerated by a rapid sublease program. AMZN embarked on an aggressive sublease program, starting with over three million square feet listed in September 2022.

According to CSGP, AMZN has cut its industrial footprint by approximately 3% since 2022. While this was a modest reduction in terms of their overall footprint, it amounts to a discharge of approximately 14 million square feet.

Amazon has pulled out of more than 14 million square feet of distribution space across the U.S. over the past 16 months as it seeks to cut spiraling expenses resulting from its record growth during the pandemic. That amounts to about 3% of Amazon’s U.S. logistics footprint as tracked by CoStar.

Most of these closures occurred during the second half of 2022, when the e-commerce giant was focused on shuttering older, less-efficient facilities, and opted to put more than 30 of its distribution centers in properties built before 2010 back on the market for lease.

The cost reductions accrued by no longer operating those warehouses have clearly had a positive impact on the company’s bottom line. Excluding Amazon Web Services, Amazon’s North American business swung from consistent losses in 2022, to profitability during the first three quarters of 2023.

AMZN’s closure of distribution centers was slow during the first half of 2023. However, AMZN began accelerating sublease listings in October 2023, marking the highest total in over one year. One key detail according to CSGP is that these closures include warehouses leased through 2030 and beyond, meaning AMZN is making meaningful long term changes as opposed to getting ahead of expiring leases.

Included is this round of closures are five large distribution centers including a 1.1 million SF building in Atlanta, a 350,000 SF building in San Antonio, and a 219,000 SF building in Fort Worth. These three assets are newer vintages that AMZN occupied between 2020 and 2022, rather than older vintage assets which AMZN has typically left or put up for sublease.

Amazon Continues To Modernize

Exiting 2023 and moving into 2024, AMZN continues to sign new industrial leases. Most of these new occupancies are in untapped markets as AMZN continues to expand their footprint across the United States. While AMZN continues inking new leases, their overall footprint has remained relatively flat in 2023. CSGP identified 6.7 million SF that AMZN either vacated or offered for sublease. In contrast, CSGP was able to identify 6.9 million SF of new leases during the same period.

Many of these changes came as part of the shift towards AMZN’s “hub and spoke” strategy, which aims to expand AMZN’s footprint more comprehensively across localities. Market participants in the real estate sector have taken note of the shifts in AMZN’s leasing behavior.

Insight from the first quarter earnings call of STAG, indicated AMZN remains a key participant in the leasing of industrial real estate. This past quarter, a “very large e-commerce tenant” was active in leasing space in their portfolio. CEO Bill Crooker hinted towards a normalization of AMZN’s leasing activity.

STAG Q1 2024 Earnings Call

Bill Crow (Raymond James)

Most of my questions have been answered. But you alluded to stronger leasing and some big box space. I’m wondering if that’s e-commerce tenants or whether there’s any kind of theme in the demand that you’re seeing there?

Bill Crooker (CEO, STAG Industrial)

Yes. I mean, there’s one very large e-commerce tenant that we’re all household name that’s leased some of the space. Some big retailers took some space. And I think another one was a large e-commerce tenant too. Yes. So I was just looking over to Steve and he’s shaking his head, yes, so I got that one right. But I just want to caution those comments in that this is the start of it, right? So I don’t want my comments to be extrapolated like big box pack where everything is healthy there. But it’s starting, we’re seeing some positive signs there, which is great. I just — I don’t want to oversell that.”

In addition to the property owned by STAG, AMZN recently committed to lease more than 1.2 million square feet in Vacaville, CA. AMZN’s return to positive leasing velocity is a positive indicator for the continued expansion of their e-commerce business.

Results of Modernization

AMZN has previously indicated that streamlining their distribution network resulted in meaningful shifts in profitability. In fact, the shift from a regional distribution model to their so called “hub and spoke” or “wheel’ strategy precipitated a positive shift in profit for the third quarter of 2023. The modernized strategy focused on localization, which reduced the overall footprint as well as shipping costs and delivery times. This was a clear win-win for AMZN, which propelled profitability.

According to AMZN, the shifting logistics strategy drove a 13% bump in quarterly sales to over $143 billion for the quarter, but more crucially a nearly 30% increase in net income.

The benefits of moving from a single national fulfillment network in the U.S. to eight distinct regions are exceeding our optimistic expectations, and perhaps most importantly, putting us on pace to deliver the fastest delivery speeds for Prime customers in our 29-year history,” CEO Andy Jassy told investors on a call to discuss the company’s earnings.

Jassy has focused this year on cutting costs by reducing real estate costs, laying off workers and cutting back hiring. However, Amazon said it will hire 250,000 full-time, part-time and seasonal employees in the United States to handle an expected rush of online buying in the upcoming holiday season.

AMZN responded quickly to oversaturation of their logistics network. Continuing their history of leading the way with innovative changes, AMZN was able to retain their quality assets while culling unnecessary, costly assets.

The transformation of AMZN’s logistics continues to pay off. On the first quarter earnings call, Andy Jassy continued singing the praises of the progress being made within AMZN’s fulfillment centers. Specifically, Jassy mentioned process improvements which resulted in more units per box, reducing material and delivery costs considerably.

AMZN Q1 2024 Earnings Call

Andy Jassy (CEO, Amazon)

Over the past year, we’ve talked about how our regionalization efforts have helped to lower our cost to serve. We’ve continued to inspect our fulfillment network for additional opportunities and are working on several areas where we believe we can lower costs even further while also improving customer experience. One example of this is our work to increase the consolidation of units into fewer boxes. As we further optimize our network, we’ve seen an increase in the number of units delivered per box, an important driver for reducing our cost. When we’re able to consolidate more units into a box, it results in fewer boxes and deliveries, a better customer experience, reduces our cost to serve, and lowers our carbon impact. Another prominent example is our efforts to revamp our U.S. inbound fulfillment architecture to allow for better inventory placement closer to our customers.

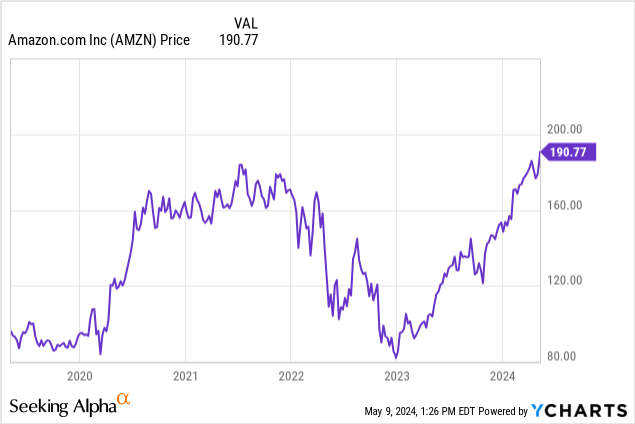

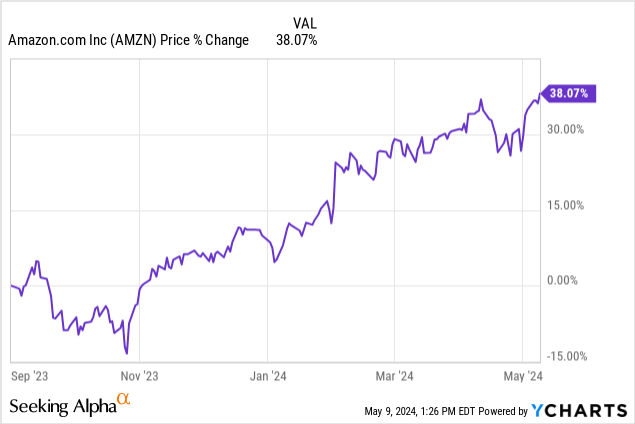

The results of these changes have been key for AMZN shareholders. Over the past several years, AMZN’s share price has been somewhat tumultuous, largely on account of these over-saturation issues following the pandemic.

However, the benefits of AMZN’s efforts to resolve these issues are paying off. Since AMZN acknowledged the benefits of these transformative initiatives, AMZN’s stock price has appreciated by over 30%. Looking forward, AMZN has returned to an expansive position, actively leasing new assets while continuing to list assets for sublease. This means AMZN continues to recognize cost efficiencies within their real estate footprint, which could be valuable to shareholders.

The success that AMZN has realized over the past several quarters provides proof of concept for their innovative logistics strategy. Accelerating activity within their real estate footprint indicates that AMZN is doubling down on a winning strategy.

Conclusion

As the footprint continues to grow and transform, AMZN’s proactive strategy is a positive sign for shareholders, earning the stock a “Buy.” Many competing retailers have struggled to adequately revamp their logistics networks to keep up. As a result, AMZN remains one of the most important participants, setting a gold standard across the industrial market. While AMZN’s accelerating activity is a positive leading indicator for the e-commerce giant, it also represents opportunity for industrial developers and landlords who will benefit from the increased demand.