IvanC7/iStock via Getty Images

Preamble

In April last year, I penned an article that covered several trends that would hoist the price of gold in a heavenly direction. Since the article, gold has indeed bounded to new highs. This may be a delight to see if you are comfortably seated on a large lump of the stuff. However, it’s a signal that something has gone awry, either economically or geopolitically, which is ominous news for everyone. This is the second article on a similar theme that outlines a number of other trends, that will again, I believe, light the blue touchpaper under the price of gold, and with it SPDR Gold Shares ETF (NYSEARCA:GLD).

Demand For Dollars

The capitalist laws of supply and demand apply to most tradable items, including the USD. If the Fed prints too many dollars, it can lead to a situation akin to a market flooded with some doodad or other. In these circumstances, each individual dollar becomes less valuable, that is to say it takes more dollars to purchase the same goods and services. A weak demand for USD can also have the same impact on the purchasing power of the USD.

I wouldn’t be surprised if those reading these lines hear details of the national debt at least once a week. Also distressing to hear is that there is no plausible way of paying the debt back. Even just to keep paying the interest will be a struggle given that around a trillion dollars in interest payments needs to be generated by an economy largely based on selling jam donuts, chicken tacos and providing streamed entertainment to the unemployed.

If we all know the status of US debt, then central banks from Albania through to Zambia have also got the memo. Everybody can see that the US government can’t pay the interest on its debt and doesn’t even have a published plan to do so.

So, when the Treasury holds an auction on a new issue of bonds, it’s no surprise that few bash on the FED’s door to buy. This is likely because they doubt the US government’s ability to pay interest on the new debt. As a last resort, the Federal Reserve glides in and buys some of the debt by creating “money,” as if by magic, with a couple of mouse clicks. This so called “money” then goes out into the economy and increases supply, resulting in inflationary pressure.

This then is the first trend that will boost demand for gold, thus providing a nice tailwind for the price. Whilst this may illicit an abundance Cheshire cat impersonations among gold bugs, there is a downside for the rest of the citizenry.

Downside To Diminished Demand For US Debt

Higher Borrowing Costs: When demand for US treasuries is low, the government has to offer higher interest rates to entice investors to buy them. This translates to higher borrowing costs for the US government, making it more expensive to fund its activities.

Potential for Crowding Out: The US government competes with businesses and individuals for loanable funds. If the government has to issue more treasuries at higher rates to meet its borrowing needs, it can “crowd out” private sector borrowing. This can potentially stifle economic growth as businesses may find it harder to access loans for investment and expansion.

Reduced Confidence in the US Economy: Low demand for treasuries can be interpreted by some as a lack of confidence in the US economy’s ability to repay its debt. This perception can lead to a weakening of the dollar and potentially higher interest rates across the board.

Reduced Liquidity in the Financial System: US treasuries are considered highly liquid assets. When their demand falls, it can reduce overall liquidity in the financial system, making it more difficult for banks and other institutions to lend money. This can have a chilling effect on economic activity.

Increased Volatility in Financial Markets: Lower demand for US treasuries can create uncertainty in the broader financial markets. This can lead to increased volatility in stock prices, exchange rates, and other financial instruments.

In addition to the appetite for debt, the amount of inward investment into the stock market can influence the attractiveness of USD.

The Impact Of The Economy On The Demand For USD

Since the US economy is holding up so well, foreign investors are flocking to buy US stocks, for which they are obliged to buy dollars first. In fact, these overseas investors hold a large dollop of the US stock market, which is in the order of 40%. This increased demand for dollars to purchase those stocks strengthens the USD. Conversely, if foreign investors decided to shun US investments, the USD strength would show signs of evaporating, generally a positive for gold.

Right now, it has been reported that; “Based on the average improvement in the earnings growth rate during the earnings season, the index will likely report year-over-year growth in earnings of more than 7% for the first quarter.”. The reason for this continued improvement is in part due to the efficiencies brought about through the use of AI related tools. And, even though revenue growth may slow, these efficiencies can improve earnings. I have recently covered this phenomenon, so I don’t propose to rehash a previous article. Needless to say, enhancements in earnings are a plus for the stock market, and thus inward investment. However, there are several foreboding indicators that have the potential to rock the boat, so to speak.

The Dwindling Market For US Companies

Without a doubt there are rapidly shrinking markets for US goods and services, chief among them is China. Currently, the likes of Intel and AMD earn billions from exports, but a clear downward trend in the demand for their semiconductors has been set recently, which will only accelerate in the months and years ahead. But, it’s not only chips that are being edged out of this huge market, orders for farmed commodities are being cancelled left and right.

US companies voluntarily elected to withdraw from Russia, a country of 144 million potential customers. In addition to Russia, other BRICS countries have been increasing their trade with each other in recent years. This is due to their growing economies, closer political ties, and a probable desire to be less reliant on Western economies.

The German economy has struggled since the country was disconnected from Russian energy. In fact, according to Reuters; “Germany’s vast, industry-heavy economy is now in its fourth straight quarter of zero or negative growth, weighing on all of the euro zone.” As a consequence, US companies will be selling far less to the Eurozone.

What needs to be said about the Middle East? Boycotts of US companies has started in earnest, with Starbucks being the most obvious target. According to the report; “The Starbucks operator cited business conditions as behind its decision to fire just over 10% of its workforce in its Middle Eastern and North African locations.”

Whilst the gloomy situation outlined above may not immediately impact earnings, in time there will be an effect. And when it does, the US market will become less attractive for foreign investors.

Apart from a shrinking market, there is the astonishing decline in manufacturing. Anyone can understand that if you cobble together fewer products and services, over time, this will negatively impact the stock market. There is, of course, a corresponding decline in the demand for USD.

Manufacturing Contraction

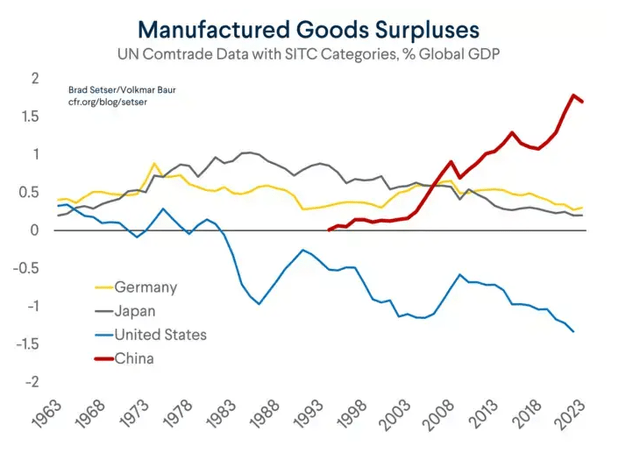

I guess, on some level, we are all aware of the deindustrialisation that has been going on for some time. But, the full extent of the process is revealed by the graphic below. What it shows is the difference between the demand for manufactured goods satisfied in the US and the surplus of stuff that can be exported.

Surplus US manufacturing (Council of Foreign Relations)

The Effect Of A Poorly Performing Stock Market

A fall in the stock market is generally considered a potential tailwind for the price of gold for the reasons given below.

Negative correlation: There’s a historical tendency for an inverse relationship between stock prices and gold prices. When the stock market falls, investors often become risk-averse and seek safer assets like gold. This increased demand for gold can drive up its price, as it did in 2008 for example.

Safe haven asset: Gold is seen as a safe haven asset during times of economic uncertainty. When the stock market falls, it can be a sign of a weakening economy or broader financial crisis. Investors may turn to gold as a way to protect their wealth during these times, believing its value will hold steady even if stock prices decline.

Lower interest rates: A falling stock market can prompt central banks to lower interest rates to stimulate the economy. Lower interest rates make gold more attractive compared to interest-bearing assets like bonds. This is because bonds become less appealing when their interest payments are lower.

However, it’s important to note that the relationship between the stock market and gold prices isn’t always perfectly negative. Other factors, such as geopolitical tensions or the US dollar’s strength, can also influence gold prices.

Dollar Depreciation

In 1971, Richard Nixon removed the US dollar’s peg to gold, so it would be interesting to calculate the percentage increase in the value of gold and the depreciation of the USD since then.

Gold Price Increase:

Starting price in 1971 was $35 per ounce

Recent price, as of Friday April 12, 2024, was around $2,343 per ounce

Percentage Increase:

((New Price – Old Price) / Old Price) x 100%

((2,343 – 35) / 35) x 100% ≈ 6,594.29%

Therefore, the price of gold has increased by approximately 6,594% since 1971, not bad.

USD Depreciation:

Since 1971, US inflation has fluctuated wildly but, some have calculated that the average inflation rate has been 3.93%. So let’s use this figure to arrive at a number to represent the USD’s depreciation since 1971.

We can use the compound interest formula to find the future value of $100 in 1971, considering the 3.93% inflation for 53 years (2024 – 1971):

Future Value (FV) = Present Value (PV) x (1 + Inflation Rate)^Number of Years

FV = $100 x (1 + 3.93%)^53 ≈ $480.

To calculate Depreciation percentage:

Depreciation percentage = ((Original Value – Value in Future Year) / Original Value) x 100%

= ((100 – 480.12) / 100) x 100% ≈ -78.01%

Therefore, based on the 3.93% inflation rate, the purchasing power of the USD has depreciated by approximately 78.01% since 1971.

Important points to remember:

- This is a simplified calculation, and actual inflation rates can fluctuate year to year.

- A more precise calculation would involve considering historical inflation data for each year.

- Depreciation refers to the purchasing power within the US, not necessarily the exchange rate with other currencies.

Finding S&P 500 Value Increase Since 1971

Let’s assume current value of the S&P 500 is 5123

Calculating Percentage Increase:

- Starting value of the S&P500 in 1971 is 700

- Current value as of Friday 12 April is 5123

Percentage Increase:

((5123 – 700) / 700) x 100% ≈ 631.86%

Therefore, based on the starting value of 700 and the assumed current value of 5123, the S&P 500 has increased by approximately 632% since 1971. Although, it is important to bear in mind that the above takes no account of the increasing dividends over the years. Still, it’s safe to say that the price of gold has appreciated well in comparison.

Other

There are other abundant tailwinds for gold I could write about, but this piece is already long enough. However, in summary, they include inflation and geopolitical stress. One must also add the current leadership we have to navigate us in the turbulent waters we now face. Here each of us needs to ask ourselves the question; “Do we have competent overlords?” If your answer leans towards the negative end of the spectrum, then consider gold.

To Conclude

To sum up, the current economic landscape presents several compelling reasons to consider investing in gold, if you haven’t already done so. There are growing signs that the demand for US debt is falling off the proverbial cliff, ominous signs of a stock market slump in the not-too-distant future, and the USD is depreciating year after year relative to the price of gold. These three trends paint a picture of uncertainty and against this backdrop, gold emerges as a reliable hedge against economic volatility and a safeguard for preserving wealth.